How We Assist Sellers to Successfully Sell Financial License Companies in Hong Kong

As a licensed and experienced business intermediary, we act on behalf of sellers to market and sell financial license companies.

Whether you are selling a TCSP license company, a Money Service Operator (MSO) license, a Trust Company, an Insurance Brokerage license, or other regulated financial businesses, our structured and secure process ensures a professional transaction experience for both sellers and buyers.

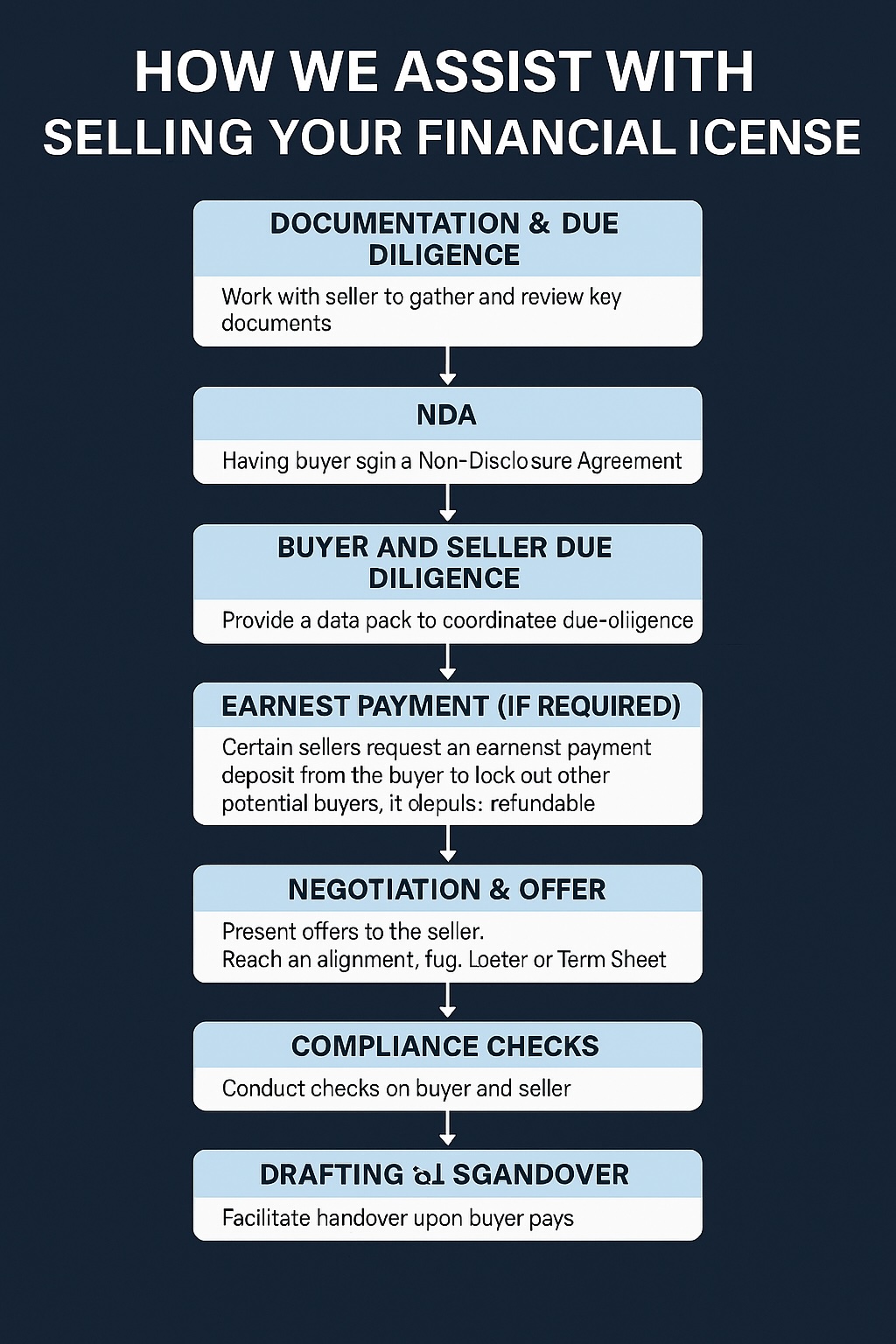

Below is an overview of our proven deal flow, applicable to all financial license sales we handle:

1. Initial Seller Engagement & Pre-Sale Preparation

Once engaged by the seller, we collect preliminary information about the licensed company in question.

Our goal is to understand the company’s licensing status, operational structure, and the seller’s target price and timeline expectations.

At this stage, we do not yet release sensitive details externally.

We also assess whether the company is in good regulatory standing and meets the basic quality thresholds to attract credible buyers.

2. Buyer Sourcing & NDA Execution

When we identify potential buyers from our qualified network, we require all prospective buyers to sign a Non-Disclosure Agreement (NDA) before releasing any confidential company information.

This protects the seller’s confidentiality and ensures that information is shared only with serious, vetted parties.

Maintaining strict confidentiality is essential in transactions involving regulated licenses.

3. Documentation Disclosure & Pre-Sale Due Diligence

Upon execution of the NDA, we release a Preliminary Data Pack containing:

-

A company profile and background

-

A copy of the financial license

-

High-level financial statements

-

Overview of compliance frameworks and internal procedures

-

Business bank account status

At the same time, we internally verify that the company is in good standing with its respective regulator, and that there are no outstanding penalties, investigations, or compliance breaches.

4. Buyer and Seller Due Diligence

We coordinate due diligence from both sides.

The buyer is invited to review the company’s licensing, operational structure, and compliance setup in greater detail.

Where necessary, the seller may also verify the buyer’s financial credibility and regulatory suitability.

We manage all information exchanges and clarifications, ensuring that the due diligence process moves efficiently.

5. Negotiation & Offer (Including Optional Earnest Payment Deposit)

Following due diligence, we guide the negotiation of terms and assist the buyer in preparing a Letter of Intent (LOI) or Term Sheet.

This document outlines the key commercial terms, including:

-

Offered purchase price

-

Payment schedule and timelines

-

Conditions precedent to completion

-

Any exclusivity terms

-

Our commission structure (if disclosed)

Earnest Payment Deposit

In many financial license transactions, it is customary for sellers to request an Earnest Payment Deposit at this stage:

-

Purpose: To demonstrate the buyer’s commitment and secure exclusivity during final negotiations.

-

Terms: The deposit is usually refundable if the transaction does not complete for reasons not caused by the buyer.

-

Handling: Clear conditions for refundability, forfeiture, and potential escrow arrangements are set out in the LOI to protect both parties.

We assist in structuring this deposit arrangement carefully to ensure transparency and fairness.

6. Compliance Checks on Buyer and Seller

Following the LOI, we conduct full KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance checks on the buyer.

This includes:

-

Identity verification

-

Proof of business activities

-

Source of funds and source of wealth documentation

-

Background checks to confirm the buyer’s suitability to hold and operate a regulated financial license

Where necessary, we reconfirm seller compliance to finalize readiness for transfer.

7. Drafting & Signing the Share Purchase Agreement (SPA)

With legal counsel support, we draft or assist in the preparation of the Share Purchase Agreement (SPA).

The SPA will include:

-

Buyer and seller representations and warranties

-

Conditions precedent (such as regulator notifications or third-party approvals)

-

Completion obligations

-

Payment terms and milestones

-

Indemnities or liabilities allocation (if applicable)

-

Commission settlement terms

Both parties sign the SPA once fully agreed, paving the way for completion.

8. Completion & Handover

Upon SPA execution and satisfaction of conditions:

-

The buyer remits the final balance of the purchase price.

-

The seller delivers:

-

Company kit, seals, and certificates

-

Business bank account access

-

Financial license documentation

-

Internal operational and compliance manuals

-

-

We assist in filing required changes with the Hong Kong Companies Registry and/or the relevant regulator, including:

-

Changes in directors, shareholders, and UBOs (Ultimate Beneficial Owners)

-

Change of company secretary (if applicable)

-

Update of registered office address (if necessary)

-

This ensures a full legal and operational transfer of control.

Why Choose Us for Financial License Sales?

By working with us, sellers benefit from:

-

Expert positioning and marketing of their licensed company to qualified buyers

-

Full confidentiality protection from initial contact to final sale

-

Compliance with Hong Kong’s regulatory standards and Codes of Practice

-

Professional transaction management from initial due diligence through post-sale support

-

Reduced risks and maximized value realization

Whether you are selling a TCSP, MSO, Trust Company, Insurance Brokerage, or another regulated business, we have the expertise and network to help you achieve a smooth, successful transaction.

📩 Interested in Selling Your Financial License?

If you are interested in arranging the sale of your financial license company with us,

please email us at: hongkong@sindacorporation.com

We look forward to assisting you with a successful transaction.

DISCLAIMER

Sinda Corporation, as a licensed business intermediary, solely provides introduction, coordination, and facilitation services between buyers and sellers for the transfer of financial license companies.

We make no warranties, representations, or guarantees—express or implied—regarding the financial standing, compliance status, license validity, operational prospects, or any other aspects of the seller’s company.

It is the buyer’s responsibility to conduct independent and thorough due diligence before proceeding with any transaction.

All purchasing decisions should be based on the buyer’s own assessment and independent professional advice.

We disclaim all liability for any transaction outcome, operational issues after transfer, or any direct or indirect losses arising from the transaction.

All information provided via this website, marketing materials, or other communications is for reference only and does not constitute legal, financial, tax, or investment advice.

We strongly encourage seeking independent professional advice where necessary.