The latest update on the EU’s non-cooperative jurisdictions for tax purposes

The EU’s list of non-cooperative jurisdictions for tax purposes is a policy that addresses the nature of global unfair tax practices, mainly some jurisdictions offering tax advantages over other countries.

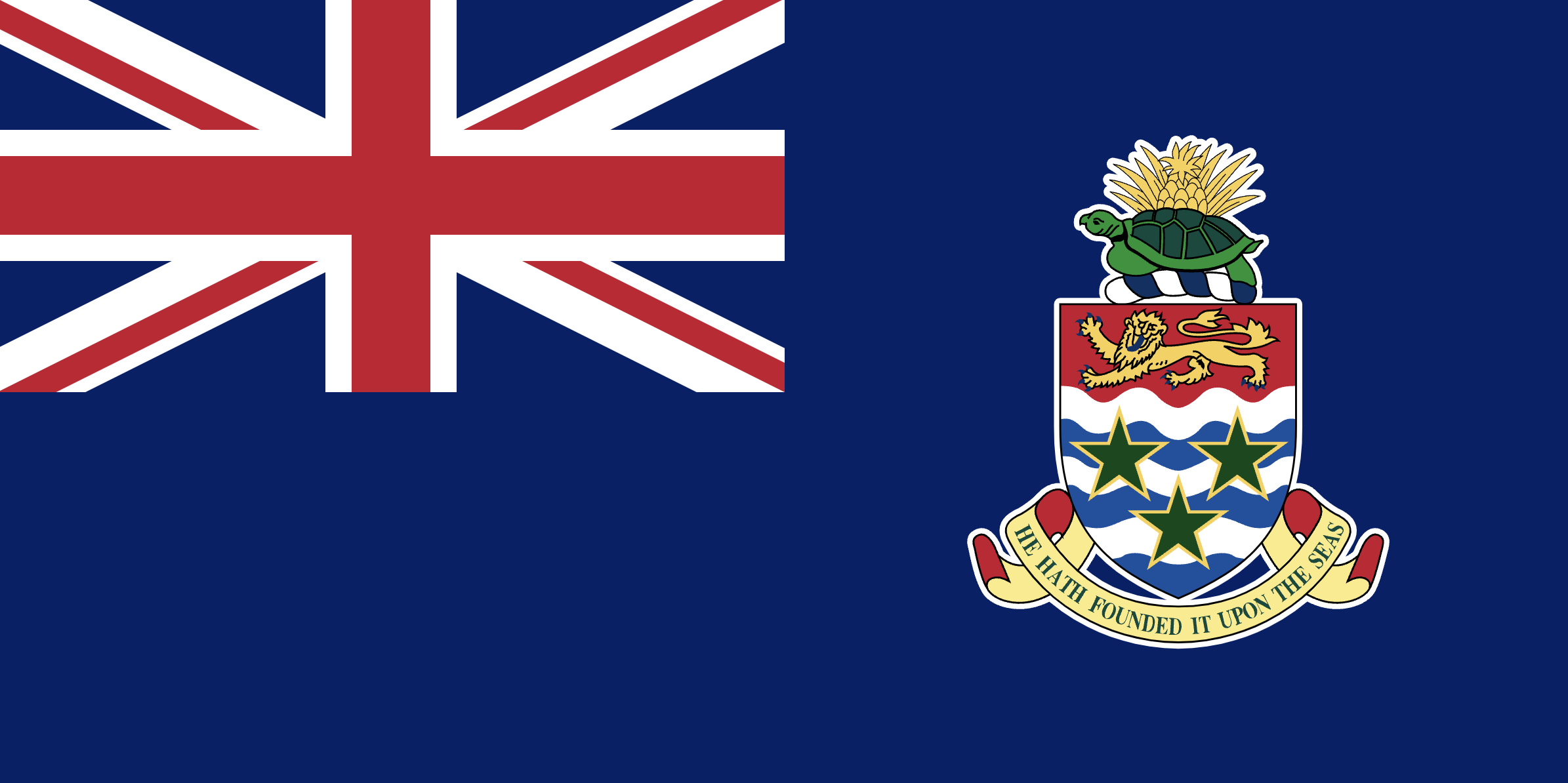

The list compiled by the European Council on the 22nd of February 2021 has the following countries:

- American Samoa

- Anguilla

- Dominica

- Fiji

- Guam

- Palau

- Panama

- Samoa

- Trinidad and Tobago

- US Virgin Islands

- Vanuatu

- Seychelles

Companies and individuals in countries on the list are likely to face increasing scrutiny in the financial sector and the trust and company services sectors when taking clients from these countries onboard.